What Is Cryptocurrency?

What Is Cryptocurrency?

Cryptocurrency is decentralized digital money that’s based on blockchain technology. You may be familiar with the most popular versions, Bitcoin and Ethereum, but there are more than 5,000 different cryptocurrencies in circulation.

How Does Cryptocurrency Work?

A cryptocurrency is a medium of exchange that is digital, encrypted and decentralized.

Unlike the U.S. Dollar or the Euro, there is no central authority that manages and maintains the value of a cryptocurrency.

You can use crypto to buy regular goods and services, although most people invest in cryptocurrencies as they would in other assets, like stocks or precious metals.

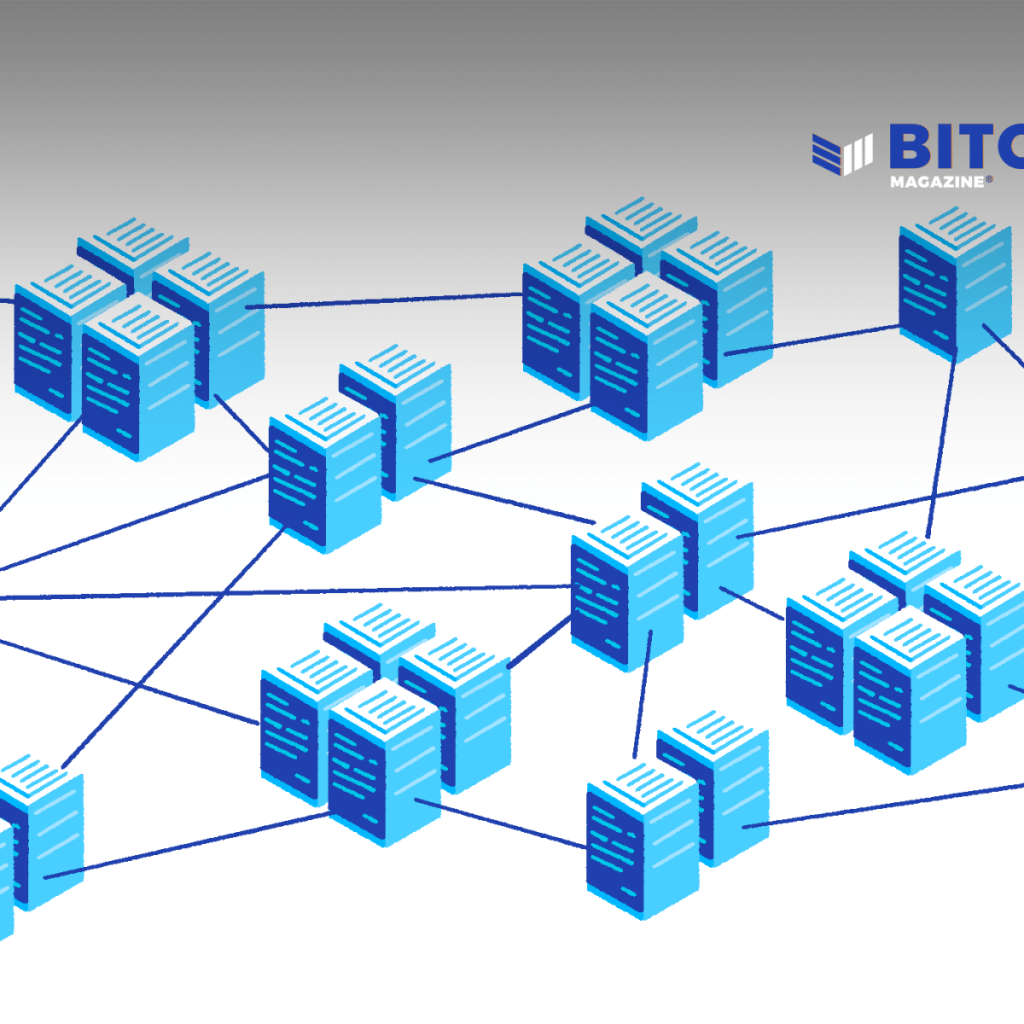

What Is a Blockchain?

A blockchain is an open, distributed ledger that records transactions in code.

“Imagine a book where you write down everything you spend money on each day,” says Buchi Okoro, CEO and co-founder of African cryptocurrency exchange Quidax.

“Each page is similar to a block, and the entire book, a group of pages, is a blockchain.”

Proof of Work vs Proof of Stake

Cryptocurrencies typically use either proof of work or proof of stake to verify transactions.

Proof of Work

“Proof of work is a method of verifying transactions on a blockchain in which an algorithm provides a mathematical problem that computers race to solve,” says Simon Oxenham, social media manager at Xcoins.com.

Each participating computer, often referred to as a “miner,” solves a mathematical puzzle that helps verify a group of transactions—referred to as a block—then adds them to the blockchain leger.

The first computer to do so successfully is rewarded with a small amount of cryptocurrency for its efforts.

This race to solve blockchain puzzles can require an intense amount of computer power and electricity.

In practice, that means the miners might barely break even with the crypto they receive for validating transactions, after considering the costs of power and computing resources.

Proof of Stake

To reduce the amount of power necessary to check transactions, some cryptocurrencies use a proof of stake verification method.

“It’s almost like bank collateral,” says Okoro.

“Because proof of stake removes energy-intensive equation solving, it’s much more efficient than proof of work, allowing for faster verification/confirmation times for transactions,” says Anton Altement, CEO of Osom Finance.

The Role of Consensus in Crypto

Both proof of stake and proof of work rely on consensus mechanisms to verify transactions.

This means while each uses individual users to verify transactions, each verified transaction must be checked and approved by the majority of ledger holders.

For example, a hacker couldn’t alter the blockchain ledger unless they successfully got at least 51% of the ledgers to match their fraudulent version.

The amount of resources necessary to do this makes fraud unlikely.

How Can You Mine Cryptocurrency?

Mining is how new units of cryptocurrency are released into the world, generally in exchange for validating transactions.

While it’s theoretically possible for the average person to mine cryptocurrency, it’s increasingly difficult in proof of work systems, like Bitcoin.

“The average consumer used to be able to do this, but now it’s just too expensive. There are too many people who have optimized their equipment and technology to outcompete.”

And remember: Proof of work cryptocurrencies require huge amounts of energy to mine.

It’s estimated that 0.21% of all of the world’s electricity goes to powering Bitcoin farms.

That’s roughly the same amount of power Switzerland uses in a year.

It does, however, require that you already own a cryptocurrency to participate. (If you have no crypto, you have nothing to stake.)

How Can You Use Cryptocurrency?

You can use cryptocurrency to make purchases, but it’s not a form of payment with mainstream acceptance quite yet. A handful of online retailers like Overstock.com accept Bitcoin, but it’s far from the norm.

At eGifter, for instance, you can use Bitcoin to buy gift cards for Dunkin Donuts, Target, Apple and select other retailers and restaurants.

You may also be able to load cryptocurrency to a debit card to make purchases.

You may also use crypto as an alternative investment option outside of stocks and bonds.

“The best-known crypto, Bitcoin, is a secure, decentralized currency that has become a store of value like gold,” says David Zeiler, a cryptocurrency expert and associate editor for financial news site Money Morning. “Some people even refer to it as ‘digital gold.’”

How to Use Cryptocurrency for Secure Purchases

Using crypto to securely make purchases depends on what you’re trying to buy.

If you’d like to spend cryptocurrency at a retailer that doesn’t accept it directly, you can use a cryptocurrency debit card, like BitPay, in the U.S.

To transfer money from your wallet, you can scan the QR code of your recipient or enter their wallet address manually.

Some services make this easier by allowing you to enter a phone number or select a contact from your phone.

Depending on the cryptocurrency, this may take between 10 minutes and two hours.

This lag time, though, is part of what makes crypto transactions secure. “A bad actor trying to alter a transaction won’t have the proper software ‘keys,’ which means the network will reject the transaction.

The network also polices and prevents double spending,” Zeiler says.

How to Invest in Cryptocurrency

Cryptocurrency can be purchased on peer-to-peer networks and cryptocurrency exchanges, such as Coinbase and Bitfinex.

Keep an eye out for fees, though, as some of these exchanges charge what can be prohibitively high costs on small crypto purchases.

Coinbase, for instance, charges a fee of 0.5% of your purchase plus a flat fee of $0.99 to $2.99 depending on the size of your transaction.

Some brokerage platforms—like Robinhood, Webull and eToro—let you invest in crypto.

They offer the ability to trade some of the most popular cryptocurrencies, including Bitcoin, Ethereum and Dogecoin, but they may also have limitations, including the inability to move crypto purchases off their platforms.

“It was once fairly difficult but now it’s relatively easy, even for crypto novices,” Zeiler says. “An exchange like Coinbase caters to non-technical folks.

It’s very easy to set up an account there and link it to a bank account.”

It’s best to keep in mind that buying individual cryptocurrencies is a little like buying individual stocks.

Rather than buying only security, its better to spread your purchases out over many different options.

If you want exposure to the crypto market, you might invest in individual stocks of crypto companies.

“There are also a few Bitcoin mining stocks such as Hive Blockchain (HIVE),” says Zeiler.

“If you want some crypto exposure with less risk, you can invest in big companies that are adopting blockchain technology, such as IBM, Bank of America and Microsoft.”

Should You Invest in Cryptocurrency?

Experts hold mixed opinions about investing in cryptocurrency.

Because crypto is a highly speculative investment, with the potential for intense price swings, some financial advisors don’t recommend people invest at all.

For example, Bitcoin nearly quadrupled in value over the course of 2020, closing out the year above $28,900.

Then BTC more than doubled again, hitting an intraday high above $68,990 on November 10, 2021—and then dropped to around $46,000 at the end of 2021.

As you can see, cryptocurrencies can be very volatile.

That’s why Peter Palion, a certified financial planner (CFP) in East Norwich, N.Y., thinks it’s safer to stick to currency that’s backed by a government, like the U.S. dollar.

Bitcoin looks basically like my last EKG, and the U.S. dollar index is more or less a flat line.

Responses