Millions for Crypto Start-Ups

For months, cryptocurrency enthusiasts poured hundreds of millions of dollars into a project called Wonderland,

Firstly, wonderland which claimed to provide a system of exchange for the murky world of decentralized finance.

To take part in the project, the investors — who called themselves Frog Nation — ntrusted their money to Wonderland’s treasury manager, a crypto developer whom they knew only by the profile name of 0xSifu.

In late January, 0xSifu was revealed to be an alias for Michael Patryn, who had served 18 months in federal prison for fraud.

The price of the Wonderland token, $TIME, crashed overnight as Frog Nation’s panicked denizens debated shutting down the project.

“I was like, ‘Oh, man, this is going to get ugly,’” said Brad Nickel, a Wonderland investor in Florida who runs the crypto podcast “Mission: DeFi.” “Immediately, that was a total loss of confidence.”

Bitcoin was conceived more than a decade ago by a mysterious figure who went by the pseudonym Satoshi Nakamoto. For years, thieves and drug dealers have used cryptocurrencies to do business in the shadows.

The ability to operate anonymously is a central tenet of crypto technology.

Secondly, All cryptocurrency transactions are recorded on decentralized ledger systems called blockchains, which let users transact namelessly, without registering a bank account or interacting with traditional financial gatekeepers.

Now as crypto transforms into an increasingly mainstream industry, even the ostensibly legitimate actors — start-up founders, engineers and investors — insist on anonymity.

A growing number of crypto entrepreneurs, many of whom control hundreds of millions of dollars in investor funds, conduct business via mysterious internet avatars scrubbed of identifying information.

Some venture capital firms are backing founders without ever learning their real names.

Last month, BuzzFeed News set off a fresh round of debate by identifying two of the pseudonymous founders of Bored Ape Yacht Club, a $2.5 billion collection of nonfungible tokens, the unique digital collectibles known as NFTs.

“This pseudonymous stuff is so dangerous,” said Brian Nguyen, a crypto entrepreneur who used a pseudonym last year before making his identity public.

Thirdly, “They could be a good actor today, but they could turn bad in two or three years.”

Mr. Nguyen once lost more than $400,000 in a common crypto scam called a rug pull, in which an anonymous developer launches a project, solicits funds from investors and then disappears with the money.

One rose to fame running an Elon Musk parody Twitter account that now has nearly two million followers.

“I don’t know who he is. I don’t know what company he worked at,” Ms. Wu said. “And I don’t need to. I know that he’s an expert in the industry.”

To Clarify, Last year, FTX recruited an influencer with the Twitter pseudonym SolanaLegend to advise corporate clients interested in NFTs.

At work, he makes one exception to the secrecy.

Over the last year, the venture capital firm Paradigm has also hired engineers and researchers who operate anonymously;

Therefore, they appear on the company’s staff page under pseudonyms. (Jim Prosser, a Paradigm spokesman, said the employees’ bosses knew their identities.)

Moreover, In interviews, anonymous crypto entrepreneurs and engineers offered a variety of reasons for concealing their names.

Some feared that a regulatory crackdown could put them in the cross hairs of law enforcement.

Others said they disliked the attention or worried that their growing wealth could make them targets for thieves and hackers.

Likewise, The nameless entrepreneurs often take extreme steps to keep their identities private, using voice-altering software on calls or requiring business partners to sign nondisclosure agreements.

Some venture firms are willing to invest in them anyway.

Last year, 0xMaki, a developer who helped run the prominent crypto project SushiSwap, raised $60 million from a group of venture investors, including Ms. Wu, without disclosing his real name to them.

(The deal fell through after members of SushiSwap — a so-called decentralized autonomous organization, or DAO, in which individual investors hold significant sway — raised concerns about the funding.)

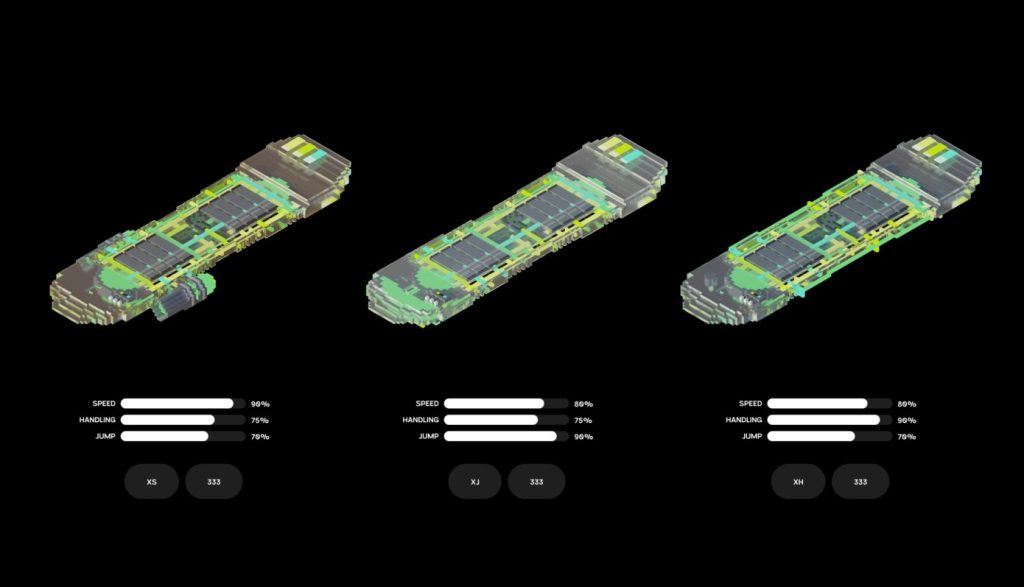

A Guide to Cryptocurrency

Card 1 of 7

A glossary. Cryptocurrencies have gone from a curiosity to a viable investment, making them almost impossible to ignore. If you are struggling with the terminology, let us help:

In Conclusion, Last summer, the anonymous founder of Alchemix, another major crypto project, raised $4.9 million from a group of venture firms led by CMS Holdings.

“A lot of these guys have reputations from over the years,” Mr. Matuszewski said.

“It doesn’t seem like it makes a ton of sense for them to run off and abscond with the funds.”

As A result,

Moreover,

Responses