Crypto Banks

The U.S. Federal Reserve published guidance detailing how crypto banks can secure master account access,

something several of these banks have wanted for over a year.

While the guidance stops short of true transparency, potential applicants now have a roadmap of sorts they can follow, while the Fed has indicated that it is indeed open to letting crypto companies (and other novel entities) access global payments rails.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Big baby step

The narrative

After over a year, the Federal Reserve published final guidance detailing how it will assess reserve account applications from banks, ranging from federally supervised entities with deposit insurance to novel financial institutions with state charters. That’s right, folks, we’re talking about Wyoming’s Special Purpose Depository Institutions (SPDI).

Why it matters

A handful of crypto companies have sought bank charters for the past few years. The reasons for doing so vary. In some cases, a federal bank or trust charter opens up the potential client list for various services. For others, being a bank means no longer needing a bank intermediary to access the global financial system. Regardless of the reasons, last week’s release provided a shot of adrenaline to these efforts, although it is just a first step.

Breaking it down

The Fed said last Monday that it was publishing its finalized guidance for novel financial institutions and other banks seeking access to its “master accounts” (otherwise known as Reserve accounts and not at all to be confused with FedAccounts). Under the published guidance, the Fed will look at how applicants meet six criteria and judge them based on what sort of institution they are.

Each applicant will have to 1) be legally allowed to apply for a Reserve Bank account, 2) verify they would not create a risk to the Federal Reserve Bank that grants them an account, 3) verify they will not create a risk to the overall payment system 4) verify they will not create a risk to the U.S. financial system 5) prove they won’t allow illicit activity and 6) show they won’t “adversely affect” the Fed’s ability to draft and apply monetary policy.

The amount of scrutiny a Fed Reserve Bank branch will apply to an applicant depends on what kind of applicant it is.

Crypto companies, like Wyoming SPDIs or New York trust entities, will mostly fall into Tier 3 (though some, like Paxos, could be classified as Tier 2).

What the Fed did not do is describe just what this scrutiny will actually look like,

or how long it may take to evaluate an application.

Julie Hill, a professor at the University of Alabama’s School of Law, noted that the final guidance is

“more or less the same” as the proposed guidance first published in April 2021.

The Fed solicited public feedback at the time, ultimately receiving more than 40 unique comments and over 280 form letters.

According to the Fed,

many of the comments provided specific feedback to the different tenets laid out in the proposed guidance.

Other commenters pushed back against the idea that

some companies without federal charters or companies with novel charters could gain access. Despite this, the Fed explicitly denied these commenters’ feedback.

“Some of the commenters to the guidelines said crypto companies or [companies] without deposit insurance should not be eligible and the guidelines don’t say that,” Hill said.

Gary De Waal, special counsel with the Katten Muchin Rosenman law firm, agreed.

“There was a lot of pushback in the comments.

This is a classic case of the traditional versus the nontraditional,

and I think the Fed has stood up well to the traditional and they said,

‘We’re not going to just say no,’” he said.

“You can see that in the responses to the comments. To me that’s very significant, people should not underestimate that.”

In a document published by the Fed detailing the comment letter,

the central bank explicitly said the guidance was meant for any eligible company to use.

“The Board does not believe that it is appropriate to categorically

exclude all novel charters from access to accounts and services.

The Board believes that the final Account Access Guidelines will provide a robust framework for analyzing and mitigating risk,”

the Fed’s guidance said.

This is good news for the crypto applicants, De Waal said. De Waal, alongside two of his Katten colleagues (former CFTC General Counsel Daniel Davis and special counsel Christina Grigorian), wrote an article for the National Law Review analyzing the guidance.

OK, but what’s the bad news?

There is more the Fed needs to explain.

While the Fed detailed its six principles, it did not explain how a company can satisfy those principles. It also has not shared what its timeline for approvals might look like.

In other words,

while we know that Tier 3 applicants will face the greatest amount of scrutiny,

we have no idea what that means.

A Federal Reserve spokesperson declined to comment about this on the record.

The Fed has a long list of risk factors, but it hasn’t shared what they are, Hill said.

The central bank may publish additional guidance that can answer these questions.

“I think this is clearly a first step, but it’s an important first step,” De Waal said. “… My hunch is the further guidelines that are published by the Reserve Bank will seem more ‘meat on the bones.’”

In the meantime, companies that have already applied for reserve account access may have to continue waiting. Of the two companies that have applied (that we know of), one has already lost patience.

Custodia Bank filed suit against the Fed earlier this year,

alleging it violated a statutory deadline to make a decision on its application.

The Federal Reserve Bank of Kansas and the Board of Governors of the Federal Reserve System, which were each named as a defendant, filed their own motions to dismiss with supporting documents.

The Board’s defense boils down to stating it is under no legal obligation to direct the Kansas branch of the Fed to approve a master account, as De Waal pointed out.

“The Board, a federal agency …

would not be an appropriate defendant even if plaintiff had any cognizable claims (and it does not),” the filing said.

The Kansas bank’s defense further says that it does not believe it has “taken an unreasonable amount of time to consider Custodia’s request,” given the circumstances (namely: That Custodia is a non-FDIC-insured state-chartered SPDI that would be the first crypto company to secure master account access if approved).

It also says it is under no obligation to grant Custodia a master account,

and it lays out the various concerns and risks that a crypto bank might pose.

Plus, it’s still crypto.

It’s this last argument that I suspect we’ll see more often. Concerns about the financial stability risks of cryptocurrencies – particularly stablecoins – are appearing more and more. The Fed (national group, not a reserve bank) even included this in the minutes of its latest Federal Open Markets Committee (FOMC) meeting.

“[The Fed staff] noted that these assets, including stablecoins, were subject to vulnerabilities – such as runs, fire sales, and excessive leverage – similar to those associated with more traditional assets,” the minutes said.

“While the recent turmoil in digital asset markets had not spread to other asset classes,

these participants saw digital assets’

rising importance and growing interconnectedness with other segments of the financial system

as underscoring the need to establish a robust supervisory

and regulatory framework for this industry that would appropriately limit potential systemic risks.

A few participants mentioned the need to strengthen the oversight and regulation of certain types of nonbank financial institutions.”

Biden’s rule

Changing of the guard

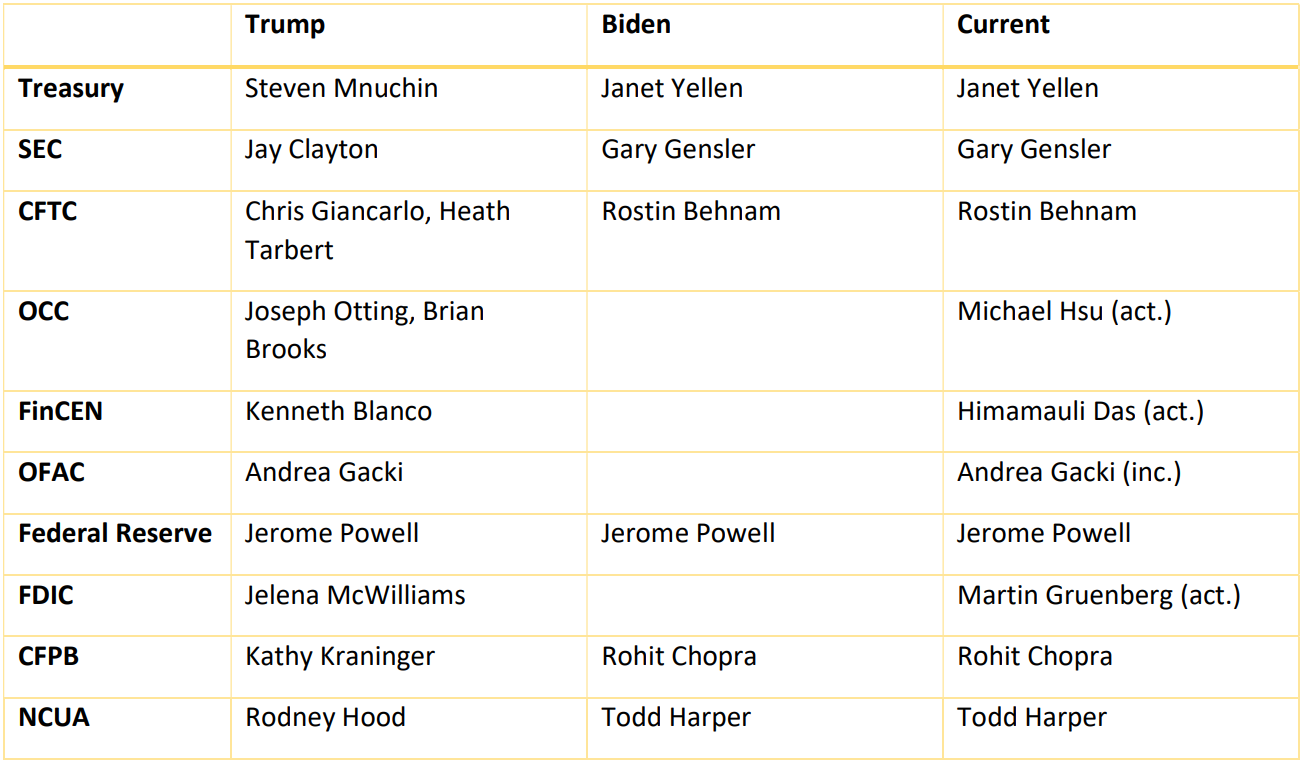

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

Elections are coming up. I wonder what those will mean for this list here.

Elsewhere:

-

Ukraine Bought Weapons, Drones With Crypto Donations: Ukraine’s government bought weapons, unmanned aerial vehicles (UAVs, better known as drones) and digital rifle scopes, besides non-lethal tools, with some of the $60 million in crypto donated after Russia invaded the European nation earlier this year, Ukraine’s minister for Digital Transformation, Ukraine’s minister for Digital Transformation, revealed Wednesday in a new breakdown of expenditures.

-

FDIC Orders Crypto Exchange FTX US, 4 Others to Cease ‘Misleading’ Claims: The U.S. Federal Deposit Insurance Corp.

-

Crypto Lender Hodlnaut Faces Singapore Police ‘Actions’ and Staggering Job Cuts: Hodlnaut, a Singapore-based crypto lender, disclosed early Friday that it had fired about 80% of its staff (40 people) and may be subject to future police proceedings.

-

As SEC Leans on Enforcement to Regulate, Crypto Lawyers Study Every Word: The U.S. Securities and Exchange Commission caused some consternation last month when it brought insider trading charges against a former Coinbase (COIN) employee, alleging that nine cryptocurrencies listed on the exchange were securities in the process. Jesse Hamilton breaks down what attorneys following the crypto sector took away from the filing.

-

Tornado Cash Developer’s Arrest in the Netherlands Draws Community Protest: More than 50 people gathered in Amsterdam to protest the arrest of blockchain developer Alexey Pertsev, who was arrested earlier this month on allegations of being involved in building the now-U.S.-sanctioned Tornado Cash, though he has yet to be formally charged with anything. This is sure to concern blockchain developers, privacy activists and, well, most people.

-

Voyager Customers Say No to ‘Retention’ Bonuses for Employees of Bankrupt Crypto Lender: Creditors of crypto lender Voyager Digital have filed an opposition to the company’s bid to pay 38 employees a collective $1.9 million as a “retention” bonus, arguing the company has done little to reduce headcount or costs. Trustee’s Office said in its own filing that some of these employees may in fact be executives or otherwise ineligible for the bonus.

Outside CoinDesk:

-

(Wall Street Journal) SEC Chair Gary Gensler wrote an op-ed for the Wall Street Journal saying that crypto markets are identical to capital markets – at least, where his agency is concerned. He pointed to BlockFi and the SEC’s recent settlement with the crypto lending platform as an example, saying BlockFi’s business model could replace crypto with any other asset and still be the same, legally speaking.

-

(Politico) U.S. President Joe Biden signed the Inflation Reduction Act into law last week. It’s a sweeping bill, and I couldn’t find many articles that provided a broad summary of the different provisions, but it does seem significant so here’s a primer from Politico.

-

(CNN) There are ongoing, simultaneous heatwaves and droughts across much of the U.S., Europe and China, which seems, I dunno, terrifying? This isn’t directly a crypto-related story but we do all live on this planet and this is clearly an important issue we should be paying attention to. More from the WSJ on the issues here.

-

(Grid News) Former CoinDesk writer Ben Powers has an interesting look at whether crypto and Web3 really are better for extremists than the, I guess “traditional,” web. The short answer seems to be “not really,” at least right now.

-

(Crypto Briefing) The U.S. Securities and Exchange Commission filed a lawsuit against Dragonchain last week, alleging it violated securities laws in a 2017 initial coin offering (ICO). Crypto Briefing’s Mitchell Moos published a massive exploration into the company, its leadership and the ICO in question. Among Moos’ findings: Multiple employees alleged that the founders threatened them legally and/or physically during their employment.

Responses